Nso stock options tax calculator

First the gain in value of stock is taxed at different rates. ISOs are attractive due to their preferential tax.

Accounting For Stock Compensation Ipohub

The tool will estimate how much tax youll pay plus your total return on your non.

. Fidelity Has the Tools Education Experience To Enhance Your Business. The tool will estimate how much tax youll pay plus your total return on your. Open an Account Now.

Medicare tax 60000 x 145 870. This explains why employee stock options are a type of deferred compensation used to motivate and retain employees. Ad For Private and Public Companies Who Want Equity Plans Done Right.

Lets get started today. When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share. Youve made a 81 net gain on your NSO 150 52 sale tax 17.

After your first year 25 of your NSO vest so you. It requires data such as. Stock options are one of the most common forms of equity compensation that a company can use to incentivize its workforce.

This way we can figure out exactly what percentages to calculate in relation to the last tax year typically 365 total days. On this page is an Incentive Stock Options or ISO calculator. Ad Were all about helping you get more from your money.

Cost of capital of shares value per share at exit. The Stock Option Plan specifies the total number of shares in the option pool. A non-qualified stock option NSO is a type of stock option used by employers to compensate and incentivize employees.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. You can find a general overview of stock options. Ad Trade with the Options Platform Awarded for 7 Consecutive Years.

On this page is a non-qualified stock option or NSO calculator. Open an Account Now. This calculator illustrates the tax benefits of exercising your stock options before IPO.

Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net. Click to follow the link and save it to your Favorites so. The Stock Option Plan specifies the employees or class of employees eligible to receive options.

Fidelity Has the Tools Education Experience To Enhance Your Business. A non-qualified stock option NSO tax calculator estimates your gain in a hypothetical exercise scenario and computes the associated costs. Stock Option Tax Calculator.

A non-qualified stock option NSO is a type of stock option used by employers to compensate and incentivize employees. The unemployment rate for persons aged 15 years and above in urban areas dipped to 76 per cent. Your compensation element is the difference between the exercise price 25 and the market price 45 on the day you.

A non-qualified stock option NSO is a type of employee stock option where you pay ordinary income tax on the difference between the grant. The calculator is very useful in evaluating the tax. Please enter your option information below to see your potential savings.

Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. How much are your stock options worth. Non-Qualified Stock Option - NSO.

Nso Stock Option Tax Calculator. Calculate the costs to exercise your stock options - including taxes. NA not sold yet Number of shares.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. This permalink creates a unique url for this online calculator with your saved information. On this page is a non-qualified stock option or NSO calculator.

Ad For Private and Public Companies Who Want Equity Plans Done Right. A non-qualified stock option NSO tax calculator estimates your gain in a hypothetical exercise scenario and computes the associated costs. It is also a type of stock-based compensation.

Nso stock options tax calculator Rabu 14 September 2022 Edit. Ad Trade with the Options Platform Awarded for 7 Consecutive Years. NSO Tax Occasion 1 - At Exercise.

January 29 2022.

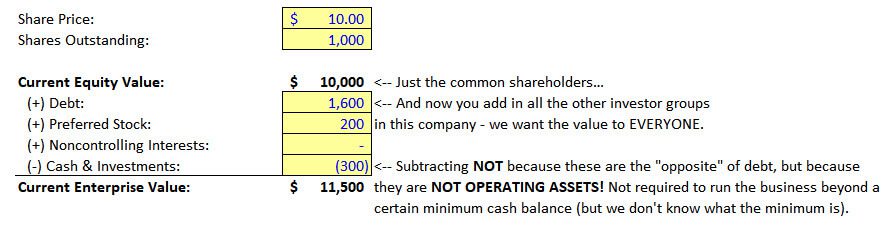

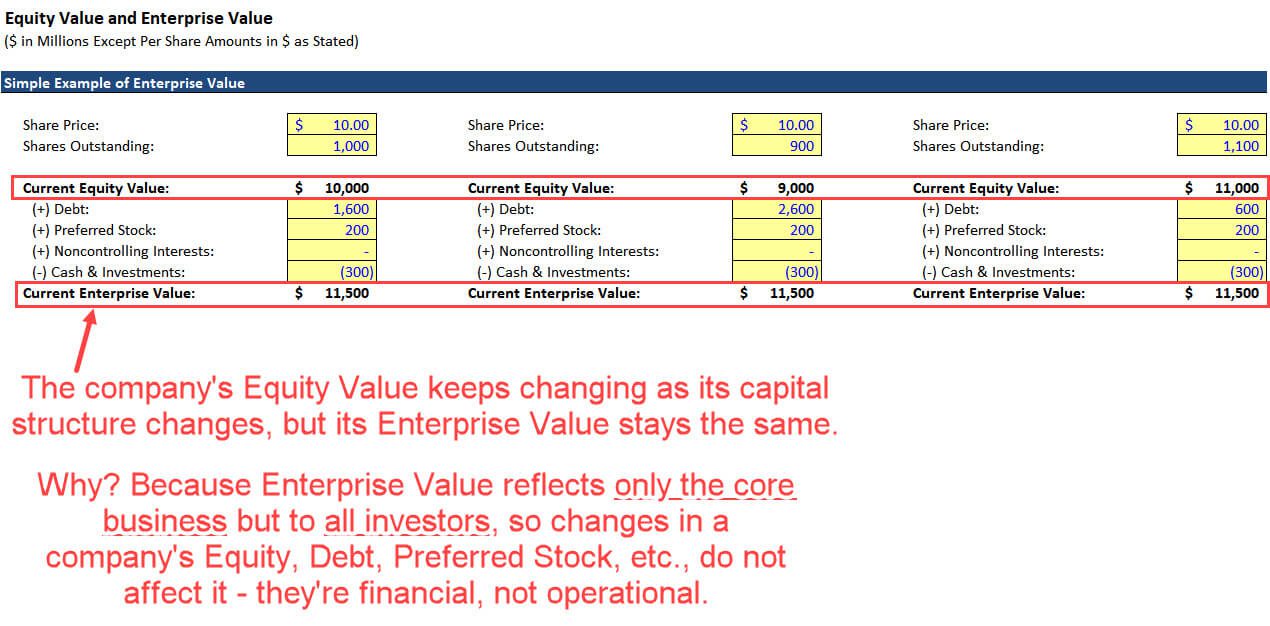

How To Calculate Enterprise Value 3 Excel Examples Video

Now That Tax Change Is More Real What Should You Do Chase Com

Restricted Stock Units Jane Financial

Stock Options To Qualify Or Not To Qualify That Is The Question Newsletters Legal News Employee Benefits Insights Foley Lardner Llp

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)

Employee Stock Options Esos A Complete Guide

Restricted Stock Units Jane Financial

Tax Planning For Stock Options

Non Qualified Stock Options Nsos

Blog Upstart Wealth

How To Calculate Enterprise Value 3 Excel Examples Video

Pro Tips 4 Tax Return Errors To Avoid With Stock Options Rsus And Stock Sales

Simple Tax Refund Calculator Or Determine If You Ll Owe

Finance Float Calculator Floating Stock Calculator The Financial Falconet

Nonqualified Stock Option Nso Tax Calculator Equity Ftw

Rsu Calculator Projecting Your Grant S Future Value

How Are Taxes Calculated On A Brokerage Account If I Withdraw

About Ebsa United States Department Of Labor Retirement Calculator Retirement Calculator Department Financial Planning